Hiring independent contractors versus employees determines your tax responsibilities and legal obligations. For global businesses, the decision also impacts market entry speed and workforce flexibility. There are many things to consider when choosing the right worker type for your business.

What's the difference between an independent contractor vs. an employee?

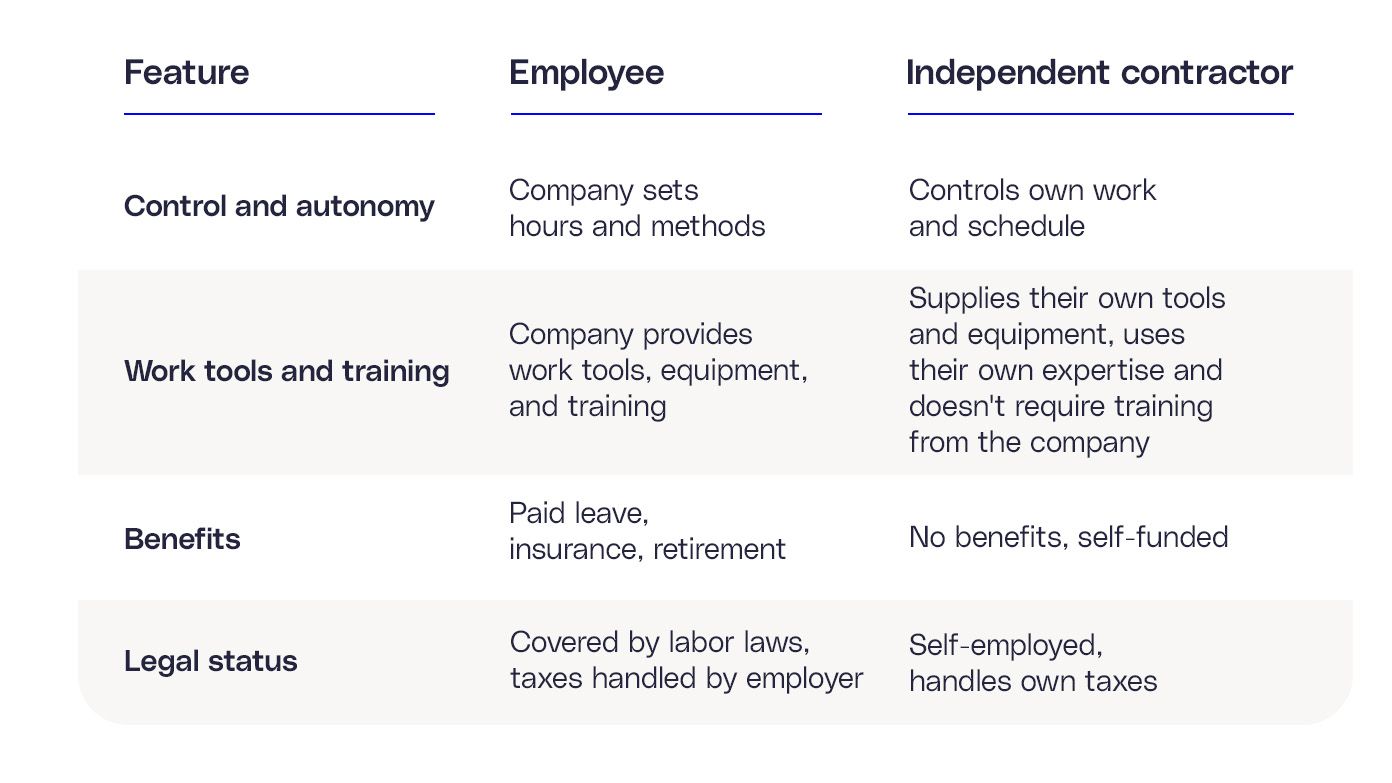

Employees work under a company's rules, follow set hours, and receive benefits. In the U.S., the average full-time employee works at least 40 hours per week. Contractors operate independently, manage their own schedules, and provide services under a contract. Key contractor-employee differences include:

-

Role and autonomy: Employees work under company supervision and direction. The employer manages work hours, methods of performing work, and their work is integrated into the core operations of the business. Contractors operate independently, determining how and when to perform the work, and their work may be distinct from the company’s core business. They also may work with multiple clients simultaneously.

-

Work tools and equipment: Employers provide employees with the necessary tools and equipment to perform their work and reimburse work expenses. Independent contractors provide their own equipment and tools and cover their expenses.

-

Benefits: Employees receive benefits such as paid leave, health insurance, and retirement plans. Most independent contractors don’t get any company-provided benefits. They're responsible for their own insurance and retirement planning.

-

Legal status: Employees are covered by local labor laws and are entitled to the rights and benefits provided under those laws. The employer manages payroll taxes, social contributions, and statutory benefits. Independent contractors are considered self-employed and not subject to employment and labor laws. They're responsible for their own taxes, insurance, and compliance obligations.

Pros and cons of hiring employees vs. contractors

|

Category |

Employee pros |

Employee cons |

Contractor pros |

Contractor cons |

|---|---|---|---|---|

|

Control |

Employer has full control over work schedule, processes, and tools |

Employer provides oversight, management, and resources |

Hiring entity can focus on deliverables without daily contractor supervision |

Hiring entity has less control over contractor schedules, work methods, and priorities |

|

Commitment |

Employees provide long-term stability and integrate into company culture |

Harder to scale up or down |

Easy to scale workforce up or down based on project needs |

Contractors may prioritize other clients |

|

Cost |

Predictable salary structure, investment in training pays off over time |

Higher ongoing costs from salaries, benefits, and taxes |

Often lower total cost with no benefits or payroll taxes |

Hourly or project rates may be higher than equivalent salary |

|

Compliance |

Rules are clearly defined under local employment laws |

Must follow strict regulations, benefits requirements, and termination rules |

Simplified compliance in some countries, with fewer benefits and tax obligations |

Risk of worker misclassification if the contractor meets employee criteria |

|

Skills access |

Can build specialized in-house expertise for long-term growth |

Employees may need more upfront training for specific roles |

Access to many skills and expertise on-demand |

When contractors move on from a project, their skills go with them |

|

Summary |

Strengthens long-term market presence and relationships |

Higher tax and benefits costs |

Can test global market entry before setting up an entity |

Worker misclassification can trigger back payments and penalties |

Why hire an employee vs. a contractor

Hiring an employee can be more beneficial if you need stability and long-term commitment. Employees support business continuity and contribute to company culture. Prioritize hiring an employee for:

-

Core business roles: Positions that impact daily operations or product quality benefit from consistent oversight and company process alignment.

-

Sensitive data access: Employees follow stricter confidentiality and security protocols, which lowers the risk of data breaches.

-

Client-facing positions: These individuals must build trust and align with corporate values.

-

Regulated industries: In the financial, healthcare, and defense sectors, full-time employees help meet industry-specific compliance obligations.

Long-term employees gain deep knowledge of your products, processes, and customer relationships. This expertise strengthens resilience during transitions or market disruptions. Employees also come with risk mitigation and compliance benefits:

-

Clear classification: Employees fit defined legal frameworks in most countries, reducing worker misclassification risks.

-

Regulatory compliance: Employers can meet statutory obligations for benefits, working hours, and workplace safety.

Stronger work output control: Labor laws give employers more authority over employees' work methods, quality, and training.

Why hire an independent contractor vs. a temporary employee

Independent contractors and temporary employees offer short-term workforce solutions. A temporary employee is hired for a fixed period. They work under your supervision and follow your company's policies. They differ from independent contractors in these ways:

-

Autonomy: A temporary employee works under the employer's direction and follows established processes.

-

Employment status: Temporary employees are on your company payroll.

-

Benefits: Temporary employees may be entitled to statutory benefits, depending on local laws and employment duration.

-

Compliance: Independent contractors are governed by their contract terms. Temporary employees are covered by local labor and employment laws.

-

Cost structure: While independent contractors are paid per project or deliverable, temporary employees are paid hourly or by salary. You may owe them benefits and contributions.

-

Flexibility: Hiring a contractor allows you to enter a new global market without the commitment of full-time employment.

|

|

Contractor |

Temporary employee |

|---|---|---|

|

Project-based work |

Ideal for specialized projects like software development or marketing campaigns |

Suitable for roles requiring integration with existing teams, such as admin support during system transitions |

|

Seasonal needs |

Best for roles needing minimal guidance, such as freelance design for seasonal product launches |

Effective for retail or hospitality during peak periods when in-person coordination is critical |

|

Specialized expertise |

Access to niche technical or legal expertise not available in-house |

Fills skills gaps for defined periods without committing to a permanent hire |

|

Compliance considerations |

Worker misclassification has higher risks if their work arrangement mirrors that of an employee under local law |

Is entitled to statutory protections and may trigger headcount-related regulatory obligations in some countries |

|

Cost considerations |

Can be more cost-effective for short, specialized projects by avoiding long-term salary and benefits commitments |

May have higher total costs due to payroll taxes and benefits, but offers more operational control and cultural alignment |

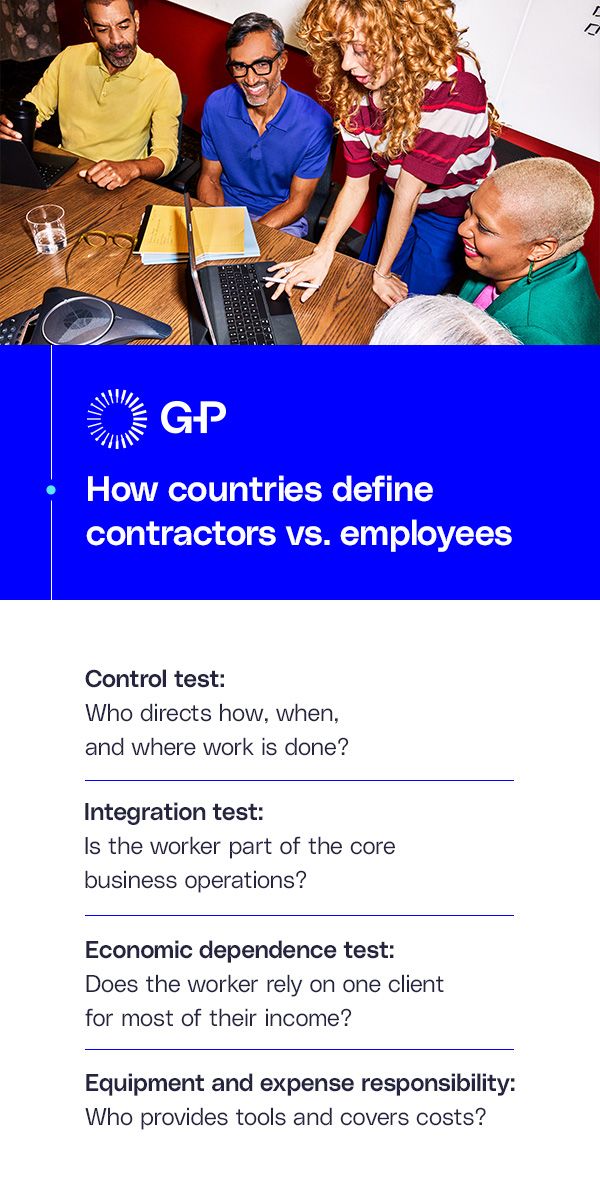

How countries define contractors vs. employees

Contractor and employee definitions vary by country, but many laws focus on the degree of independence and business integration. Most jurisdictions apply these tests to determine status:

-

Control test: Who directs how, when, and where work is done?

-

Integration test: Is the worker part of the core business operations?

-

Economic dependence test: Does the worker rely on one client for most of their income?

-

Equipment and expense responsibility: Who provides tools and covers costs?

In the U.S the two primary federal agencies, the Internal Revenue Service (IRS) and the Department of Labor (DOL), currently use different tests for worker classification, which can lead to different outcomes for the same worker. The IRS relates to employment status for federal tax purposes. The DOL test determines employment status under the Fair Labor Standards Act (FLSA), which governs minimum wage and overtime. Generally, you want to look at the DOL test first. In the U.S., the IRS uses a three-category test — behavioral control, financial control, and relationship type — to define contractors and employees. Currently, the U.S. Department of Labor (DOL) applies an “economic reality” test that looks at various factors to determine whether a worker is in business for themselves or dependent on the hiring company.

In the European Union (EU), worker classification focuses on control, integration, and dependency. Countries such as Germany have strict penalties for false self-employment. Definitions vary in the Asia-Pacific region. Australia prioritizes contract terms, while India and Singapore focus on supervision and statutory compliance. In Latin America, most countries, including Brazil and Mexico, assume employee status unless you can give clear evidence of independence.

With G-P Contractor™, you can instantly check contracts for misclassification and get actionable guidance to protect your business from costly fines. G-P Contractor brings all contractors and contracts into one place so you can run fast, accurate payment cycles in 190+ countries and over 130 currencies.

Business implications

One contract template won't meet all legal standards if your company operates in different countries. Follow these best practices to keep your business compliant:

-

Do jurisdiction-specific classification reviews before hiring.

-

Align contracts with actual working conditions.

-

Maintain evidence supporting classification decisions.

-

Review worker status periodically as roles evolve.

Work permit considerations for international contractors and employees

Securing the right work permits for your global workers keeps your business running smoothly. Without the right work authorization, you can face project delays, trigger fines, and damage your ability to operate in key markets.

Visa and work permit needs

Employees usually need an employer-sponsored work visa tied to a specific role and location. These permits can have strict conditions, such as employment contracts and proof of qualifications.

Contractors can enter certain countries on business visitor visas for short-term activities (such as attending meetings or negotiating contracts). Many jurisdictions strictly regulate what constitutes permissible "business visitor" activity, and performing actual work may require a contractor-specific permit or even a local entity. Violating these rules can result in fines, deportation, or bans. Rules differ by country, and some markets, such as the EU, require extra registration, even for short stays. It's worth noting that contractors don’t need a work visa if they work remotely from their own country for an international company.

Noncompliance risks

Hiring individuals without the right authorization can lead to fines, back taxes, visa cancellations, and travel bans. You may even get restrictions on future work permit sponsorships. In severe cases, executives can be held personally liable. Reputational harm can affect customer trust and employee morale.

How EOR solutions streamline global mobility

Employer of record (EOR) solutions, such as G-P EOR, manage compliance, so you don't have to. An EOR provider has in-country expertise and reduces the risk of worker misclassification. EORs handle document preparation and adapt processes to local law, allowing your business to hire talent quickly and legally.

Risks of misclassifying international contractors and how to mitigate them

Companies that misclassify workers can face financial penalties, legal action, and reputational damage. Internationally, classification is even more complex.

In some countries, like France, the misclassified worker can claim employee benefits. If the misclassified worker has a visa that requires employee status, the company can be banned from future hiring in that country.

Penalties depend on your business's size, the duration of the misclassification, and whether it was intentional.

Take these steps to reduce risk:

-

Review the labor regulations that apply to your team.

-

Conduct regular audits.

-

Keep contracts clear and updated.

-

Consult legal and HR experts throughout the process.

With G-P™, you can hire both international employees and contractors quickly and compliantly.

Payment and tax considerations for independent contractors vs. employees

Hiring employees internationally comes with various tax obligations. For example, most countries require employers to withhold income tax from employees' wages.

Social security is another consideration. Many times, employees working internationally contribute to the system in the country where they live and work, rather than the country where they're citizens. It is rare that employees contribute to social security for a country that they do not live and work in. Totalization agreements, such as the one between the U.S. and the U.K., are designed to prevent double social security taxation and help determine which country's system an employee should contribute to.

Businesses can also trigger permanent establishment in countries where they hire. This means your business is considered to have a taxable presence in the country, even if you don't have a formal branch there.

Many businesses hire contractors to explore new markets without the commitment of full-time employment. If you go this route, make sure you classify your workers according to local labor laws.

Hire employees and contractors with G-P

While contractors offer flexibility, employees support operational stability and cultural alignment. With G-P, you can hire both types of workers quickly and compliantly.

As the recognized leader in global employment, G-P helps companies of all sizes hire, onboard, and manage global teams in 180+ countries, regardless of entity status. Our AI-powered EOR and Contractor products are backed by the largest team of in-country HR, legal, and compliance experts to streamline and simplify the entire global employment lifecycle.