Expanding your business to Belarus offers access to a skilled workforce and a strategic European location. However, establishing compliant payroll requires a deep understanding of the country’s specific tax and labor regulations. Navigating these requirements is essential for successful operations.

G-P simplifies global expansion. As your Employer of Record (EOR) in Belarus, we manage the complexities of local payroll and employment compliance, allowing you to focus on growing your business.

Belarus payroll and tax regulations

Employers in Belarus are responsible for withholding taxes and making social security contributions on behalf of their employees. All payments and payroll records must be in the local currency, the Belarusian Ruble (BYN).

Personal income tax

Employers must withhold PIT from employee salaries. As of 2025, Belarus has a flat PIT rate of 13% for most types of income, including salaries.

Social security contributions

In Belarus, a robust social security system provides benefits for pensions, sickness, and maternity leave. Both employers and employees are required to make contributions to the State Social Protection Fund (SPF).

Employers are responsible for contributing approximately 34% of an employee’s gross salary:

- 28% for disability, old age, and survivor pensions.

- 6% for social insurance, which covers sickness and maternity benefits.

Employees also contribute 1% of their gross salary to the social security system.

Mandatory accident insurance

In addition to SPF contributions, employers must contribute between 0.1% and 1.0% of payroll for Workers’ Injury Benefits, with the specific rate determined by the company’s industry and risk profile.

Key payroll considerations in Belarus

Payroll cycle and payment

According to the Labor Code of Belarus, salaries must be paid at least twice a month. The specific pay dates should be defined in the employment contract or collective bargaining agreement.

Payslips and reporting

Employers are legally required to provide each employee with a detailed payslip (расчетный листок) with every salary payment. This document must itemize the gross salary, all deductions (taxes, social security), and the final net amount paid. Employers must also submit regular reports to the tax authorities and the Social Protection Fund.

Termination and severance

Employment contracts must outline terms for termination. Belarusian labor law allows for a probationary period of up to 3 months. In cases of termination due to redundancy or liquidation of the company, employees are typically entitled to severance pay equal to a minimum of 3 months’ average earnings.

Belarus payroll options for companies

Companies expanding to Belarus generally consider 3 payroll options:

- Internal Payroll: A large company with a long-term commitment to Belarus may establish an in-house payroll department. This approach requires hiring dedicated staff with expertise in local regulations and significant administrative overhead.

- Local Payroll Processing Company: Outsourcing to a local firm can handle payroll calculations. However, your company remains legally responsible for all compliance, including any errors made by the vendor.

- G-P: Partnering with a global EOR like G-P is the most comprehensive solution. We handle all aspects of Belarus payroll, tax, and compliance, taking on the associated risks and ensuring your employees are paid correctly and on time.

Simplify Belarus payroll with G-P

Setting up a subsidiary in Belarus can take weeks or months before you can legally run payroll. With G-P’s EOR solution, you can bypass this lengthy process. We hire employees on your behalf through our compliant local entity, allowing you to start operations in a matter of days while we manage all payroll and HR functions.

Streamline global payroll management with G-P

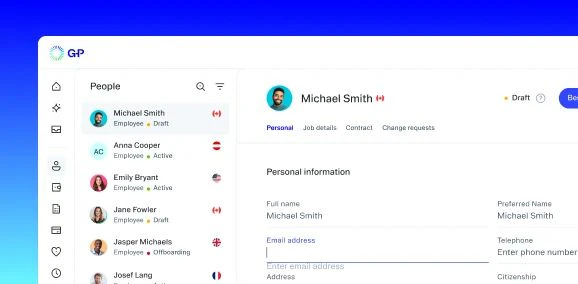

G-P streamlines each step of the payroll management process with our market-leading Global Growth Platform™. Pay your team with confidence anywhere in the world in 150 currencies with our 99% on-time automated payroll system — all with just a few clicks. Our products also integrate with leading HCM solutions, syncing employee payroll data across platforms automatically to create one reliable, convenient source of truth for HR teams.

Contact us to learn more about how we can support you.