גידול החברה שלך למערב אפריקה יכול להיות הזדמנות מרגשת. אתה תקבל ליצור קשרים עסקיים חדשים ולהגיע ללקוחות חדשים. למרות כל היתרונות, עם זאת, ללמוד כיצד להקים חברת בת בורקינה פאסו הוא תהליך מורכב שיכול לקחת כמה חודשים כדי להשלים. בנוסף, זה בנוסף לניהול חברת האם שלך, שכירת עובדים חדשים, ולימוד מערכת חדשה לגמרי של חוקי עבודה.

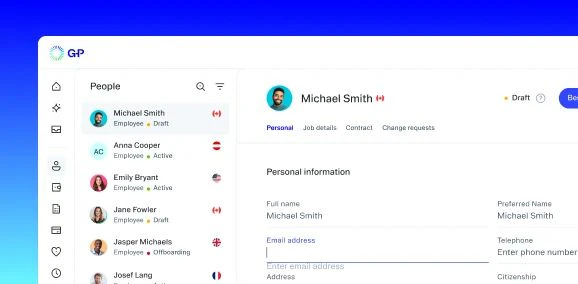

כמעסיק גלובלי של שיא (EOR), G-P מבינה את האתגרים של התרחבות גלובלית. אנו מצמצמים את הסיכונים הקשורים ומסייעים לחברות להתרחב מהר יותר ללא מתח ודאגה של ציות. כאשר אתה עובד איתנו, אתה יכול לעקוף הגדרת ישות ולהתחיל לעבוד בשבריר מהזמן.

כיצד להקים חברת בת Burkina Faso

אם תחליט לקחת את מסלול ההרחבה המסורתי, הקמת חברת בת של בורקינה פאסו כרוכה במספר צעדים, כולל בחירת המיקום עבור שטח המשרד שלך. ערים ואזורים שונים יכולים לפעול כמו מדינות, תוך שימוש בחוקים משלהם המשפיעים על ההתאגדות. תמיד לחקור מיקום פוטנציאלי לפני שילוב כדי לראות אם זה קל או קשה להקים חברת בת, או לעבוד עם יועץ שיכול להמליץ על המיקומים הטובים ביותר.

לחברות יש מגוון אפשרויות בכל הנוגע להקמת חברת בת של בורקינה פאסו. המדינה מאפשרת לישויות כגון חברה בערבון מוגבל (LLC), סניף או חברה ציבורית מוגבלת. לכל מבנה יש חוקים, תקנות והגבלות משלו על פעולות, אשר ישפיעו על האופן שבו אתה מנהל את העסק שלך.

חברות המתכננות לפעול במדינה לטווח ארוך לעתים קרובות לבחור להקים LLC. עם LLC, אתה יכול להציע מגוון רחב של מוצרים ושירותים, ליהנות מחוקים ידידותיים למס, ולהגן על חברת האם שלך מפני אחריות. שלבי תהליך הגדרת חברת הבת של בורקינה פאסו כוללים:

- פתיחת חשבון בנק Burkina Faso

- הפקדת הון המניות המינימלי שלך בחשבון הבנק.

- מתן הוכחה להפקדת ההון שלך.

- רשום את Centres de Formalités des Enterprises (CEFOREs).

- הגשת בקשה לכל רישיון נדרש.

- קבלת רישיון עסק באמצעות משרד המסחר.

- הרשמה לכל דרישות החשבונאות והמס.

חוקי חברת הבת בורקינה פאסו

חוקי חברת הבת של בורקינה פאסו תלויים בסוג הישות שתבחר להתאגדות. לדוגמה, LLCs יש כללים נפרדים לעומת משרדי סניפים וחברות מוגבלות ציבוריות. אתה צריך לפחות דירקטור אחד ובעל מניות אחד, שיכול להיות בעל אזרחות כלשהי, כדי להקים חברת בת של בורקינה פאסו כ- LLC.

חובות המס של LLC כוללות מינוי מבקר להגשת דוחות כספיים מבוקרים שנתיים. אתה גם צריך לשמור את הרשומות הפיננסיות שלך בצרפתית במשרד שלך על פי חוקי OHADA. אם אינך דובר צרפתית שוטפת, תצטרך לשכור צוות כדי לשמור על הצהרות אלה או לעבוד עם צד שלישי.

היתרונות של הקמת חברת בת Burkina Faso

למרות שזה יכול לקחת קצת זמן כדי להגדיר את חברת הבת שלך בורקינה פאסו, היתרון הגדול ביותר יהיה שאתה יכול לפעול כמו חברה מקומית. עם LLC, לחברת האם יש אחריות מוגבלת מחברת הבת, ולחברת הבת יש הזדמנות לעבוד כישות נפרדת.

שיקולים חשובים אחרים

חברות המבקשות להתרחב לבורקינה פאסו באמצעות הקמת חברת בת זקוקות לזמן ולכסף כדי להשלים את התהליך. אתה עשוי להתמודד עם עמלות לאורך תהליך ההתאגדות, וזה יכול לעזור לעבוד עם מחלקת החשבונאות שלך כדי להגדיר תקציב. אתה צריך גם להתכונן לבלות זמן נסיעה הלוך ושוב לבורקינה פאסו או למנות מנהל חברה אחר לטפל בנסיעות.

היכנס לשווקים חדשים עם G-P - אין צורך בישויות חדשות.

לנצח את התחרות ולהיכנס לשווקים חדשים בתוך דקות, לא חודשים, עם G-P . קישרנו את צוות משאבי האנוש והמומחים המשפטיים המובילים בתעשייה שלנו Global Growth Platform™ כדי לסייע לכם לשכור בהתאם בלמעלה מ-180 מדינות, ובכך לבטל את הצורך בהקמת ישויות או חברות בת מקומיות.

צרו קשר עוד היום כדי ללמוד עוד על האופן שבו נוכל לייעל את תהליך הצמיחה הגלובלי.