If your company is considering expanding to Kyrgyzstan, officially known as the Kyrgyz Republic, there are several factors to consider to ensure you’re able to enter the market quickly, confidently, and compliantly.

Countries usually can’t set up their Kyrgyz Republic payroll until they have a registered entity in the country. After months of working on your expansion and officially incorporating, you can start to consider your different Kyrgyz Republic payroll options.

Taxation rules in the Kyrgyz Republic

Employees contribute 10% of their wages to social security, but employers have additional requirements to meet. As an employer, you must contribute a total of 17.25% of wages to the pension fund, medical insurance fund, and employee recovery fund.

Kyrgyz Republic payroll options for companies

The Kyrgyz Republic has several different payroll options for companies who want to expand, including:

- Internal: Depending on the size of your subsidiary, you may choose to create an internal payroll team. Keep in mind, however, that this option usually works only for larger subsidiaries with a commitment to the Kyrgyz Republic.

- Kyrgyz Republic payroll processing company: Outsourcing with a Kyrgyz Republic payroll processing company will ensure your payroll setup is taken care of, but your company will still have to worry about meeting the country’s compliance laws.

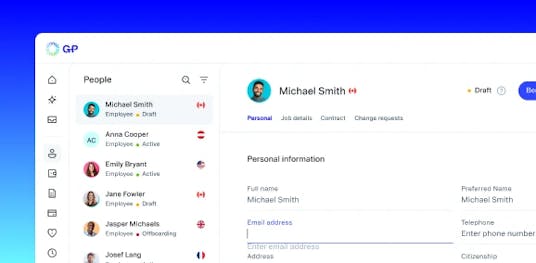

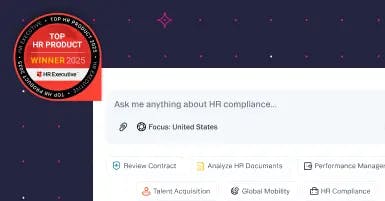

- Employer of Record (EOR): Finally, you can opt for partnering with an EOR like G-P in the Kyrgyz Republic. G-P backs its platform with the largest team of HR and legal experts to ensure your payroll setup and management is compliant and accurate. That means you can focus on growing your global teams.

How to set up a payroll in the Kyrgyz Republic

Before setting up your Kyrgyz Republic payroll, you’ll have to create a subsidiary in the country. Unfortunately, doing so can set you back anywhere from a few weeks to a few months and keep you from hiring your ideal employees.

Choosing G-P will help you start working faster. You can use our established Employer of Record to hire employees and add them to payroll. We assure you’re compliant with local laws so you can focus on managing your business.

Entitlement/termination terms

One of the most difficult aspects of employment compliance in a new country is terminating an employment contract. Locking in entitlement and termination terms as part of an employment contract can help prevent misunderstandings between you and the employee. In the Kyrgyz Republic, you can use probationary periods up to 3 months for regular employees and up to 6 months for managerial positions. Written notice depends on the cause for termination, and employees are generally entitled to severance pay.

Streamline global payroll management with G-P.

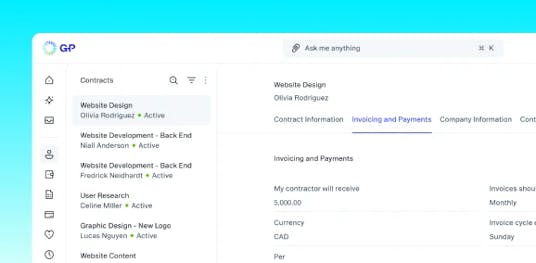

G-P streamlines each step of the payroll management process with our market-leading global employment platform. Pay your team with confidence anywhere in the world in 150 currencies with our 99% on-time automated payroll system — all with just a few clicks. Our products also integrate with leading HCM solutions, syncing employee payroll data across platforms automatically to create one reliable, convenient source of truth for HR teams.

Request a proposal to learn more about how we can support you.