I recently spoke at a panel where we asked business leaders which comes first: your people or your product? It was interesting to see the poll responses point to the product or service being the most important asset during divestitures — 44 percent of respondents gave that answer.

It goes without saying that what you sell is important, but I believe you gain an advantage when you prioritize people. Treating people as the most critical asset in a merger and acquisition project plan makes sense – they are driving those products and services. Investing more time and energy in the team, particularly in the case of employee transfers, pays off long-term.

I know from personal experience that so many things can go wrong if teams aren’t taken care of during international transactions, especially when deals cross borders. The complexities multiply on an international scale, making it even more vital for businesses to effectively plan to support their people throughout the process. But why, and how, can companies make employee transfers smoother for all involved?

Taking care of people will protect your value

In many scenarios, the intellectual property created by the employee is the true value in a transaction. Rushed transactions can lead to contractor situations, which lead to fines, complex legal issues possibly spanning multiple countries’ regulations, all which threaten the security of the company’s IP.

Protecting employees’ benefits packages with analysis and benefits matching leads to greater employee motivation. One can appreciate that this is the human approach to doing business, and there are also bottom-line benefits. Disengagement during drawn-out transfers can lead to loss of focus and lower employee retention, which might cause a drop in company value.

A study conducted by Towers Perrin, found that the major roadblocks on the route to M&A success were an inability to sustain financial performance (64 percent of respondents) loss of productivity (62 percent of respondents) and loss of key talent (53 percent of respondents). Prompt and transparent communication during international transactions helps avoid this and keep companies’ assets whole. Making the transferring employee’s experience seamless and keeping comparable benefits are critical to long-term engagement, and ultimately, value realization.

[bctt tweet=”Making the transferring employee’s experience seamless and keeping comparable benefits are critical to long-term engagement, and ultimately, value realization.” username=”globalpeo”]

It’s about your internal people too

The time and infrastructure needed to manage transfers in-house is extensive, particularly when the transaction crosses borders. And your HR team’s involvement is critical to a deal’s success. Towers Perrin found that HR team members were substantially involved in due diligence for 72 percent of successful deals analyzed, versus only 39 percent of those that failed. HR teams must learn to navigate regulations and set up payroll and benefits in different countries. In the race to the finish that is international transactions, is handling the logistics of low headcount in multiple countries the best use of your internal HR team’s time and attention?

Deloitte’s Making the Deal Work cites that many companies use external support for mergers and acquisitions to help guide the integration, during which internal teams gain hands-on training and experience that can be applied in future transactions as well as access to the external professional’s knowledge, tools, and processes. Companies should look at their internal teams and decide whether they have the time and expertise on hand, or if they should partner with specialists.

I regularly offer company leaders this pearl of wisdom: global expansion is a team sport, and the same is true for cross-border transactions. It’s important not to go it alone. Leverage people who have been there, done that, and have been successful.

Move quickly, while supporting your incoming and internal people

McKinsey reviewed major divestitures over a 25-year period and found that separations completed within 12 months of announcement delivered higher total returns to shareholders than those that took up to five years. Can it be done while prioritizing people over product?

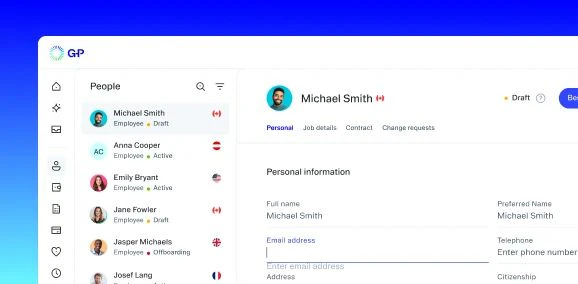

Innovation in global business has made it possible to move fast when it comes to transferring employees, without the administrative effort, legal complexity, financial burden, and HR challenges. Using a model like an Employer of Record (EOR) enables companies to leverage an already-existing, fully compliant infrastructure to onboard talent. In the case of Globalization Partners, we generate employment contracts, provide an AI-driven, automated platform for employee onboarding and offer global HR support for transferring employees, wherever they live.

For the buyer, the deal is accelerated, and sellers can trust their people are taken care of. For both sides, it reduces the red tape and negotiations involved with transition service agreements.

In a world where value creation is paramount, recognizing the importance of people as vital to the longevity of this value is a key piece of every transaction strategy.

Learn more with Globalization Partners’ M&A Playbook or connect with me and the merger and acquisition team.